Data as on 30th April 2024

Bank Of India ELSS Tax Saver

-

Fund Type : An Open Ended Equity Linked Saving Scheme with a statutory lock in of 3 years and tax benefitEntry Load : NilDate of Allotment : February 25, 2009

-

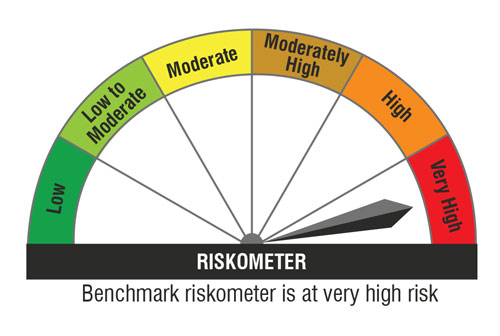

Benchmark :BSE 500 Total Return Index (TRI)Exit Load :Nil

Investment Objective

The Scheme seeks to generate long-term capital growth from a diversified portfolio of predominantly equity and equity-related securities across all market capitalizations. The Scheme is in the nature of diversified multi-cap fund. The Scheme is not providing any assured or guaranteed returns. There can be no assurance that the investment objectives of the Scheme will be realized.

Fund Manager

-

ALOK SINGH

CFA and PGDBA from ICFAI Business School.

See detail

See detail

Fund Highlights

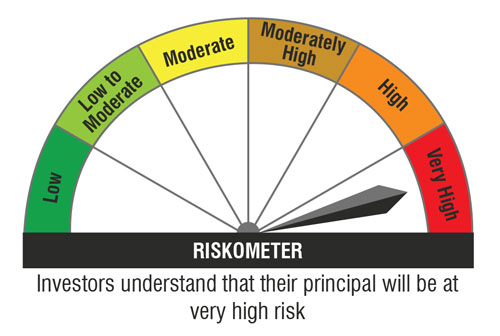

Riskometer

Top 10 Portfolio Holdings

Sector Allocation

- Portfolio weight (%)

- Benchmark weight (%)

Performance(Regular Plan – Growth)

| 1 yr | -5.1 % | 5.1 % |

| 3 yrs | 23.8 % | 21.7 % |

| 5 yrs | 25.9 % | 24.0 % |

IDCW History(Regular Plan- Regular IDCW)

| Record Date | IDCW (`/Unit) |

| 30-June-2021 | 2.00 |

| 29-July-2021 | 0.90 |

| CLICK HERE TO VIEW THE IDCW HISTORY |